tactical asset allocation | insights | June 13, 2024

Just for comparison here is the buy-and-hold sector performance.

Portfolio Holding Details by sector¶

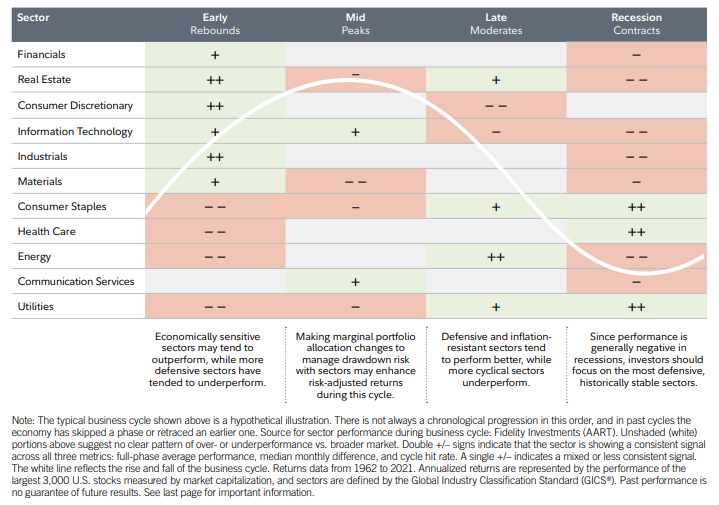

The charts below show the holdings for each sector over time. Interestingly sectors that are usually considered "low beta, non-cyclical" were not necessarily traded when typical sector rotation frameworks tell you to do so. We will write more about that in the follow-up.

Existing Sector Rotation ETFs are underperforming¶

As mentioned the crystal ball strategy can't actually be traded because you don't know the sector performance ahead of time. We found two sector rotation ETFs that you can actually buy and checked their performance. Both are active ETFs that were only recently issued. Unfortunately both of them were unable to capture the alpha potential and underperformed the market over that short period.

Lets see if we can do better with ML!